Cost of Goods Sold versus Cost of Sale in E-commerce Businesses

Paul Grieselhuber

Cost of Goods Sold versus Cost of Sale in E-commerce Businesses

For e-commerce businesses, it’s critically important to set up systems and reports that enable you to monitor the performance of your business. For newbies, this will involve quite a bit of learning but it’s important to do the work as good quality data will influence your decision making ability.

As we’ve discussed in previous articles, profitability reporting is probably the most important thing to get right as it will help you develop a good quality business case before you launch, and then live performance reporting as your business grows.

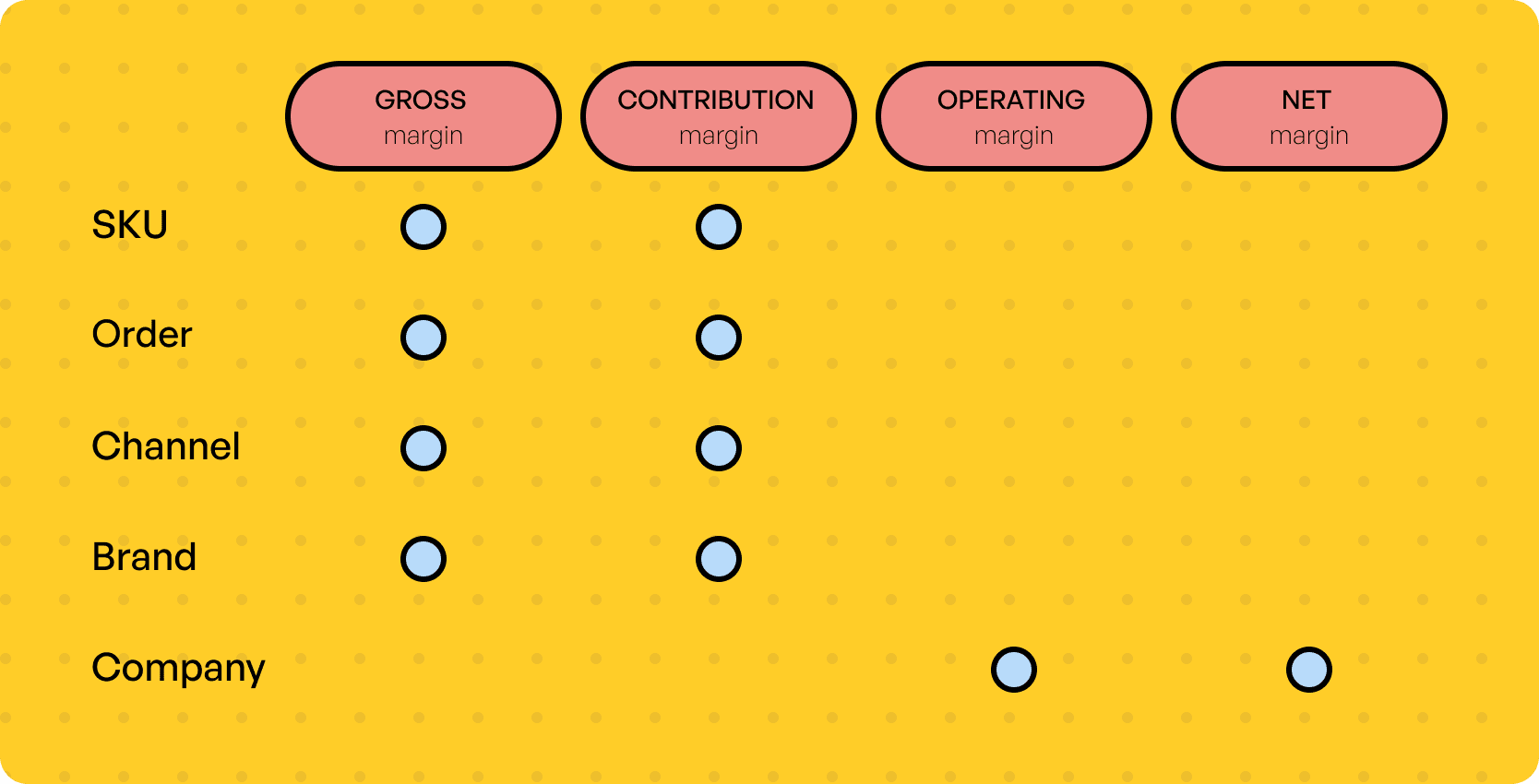

We are strong advocates of having granular level profitability reporting from the ground up, meaning at SKU level all the way up to company wide PNL and net profit statements.

Levels we measure across different metrics

The problem with COGS and CoS

The main problem we find is that COGS and CoS are often used interchangeably which can be very confusing if you’re just starting out. Even Shopify seems to get this wrong in its main article on the subject:

“Also referred to as "cost of sales," COGS includes the cost of materials and labor directly related to the production and manufacturing of retail products”.

This is the wrong way to think about the difference between COGS and CoS, and here’s why:

What is COGS?

Cost of Goods Sold is the fully loaded cost of your product in getting it prepared for sale. It only includes the direct costs associated with acquiring or creating your products.

This is applied appropriately depending on what type of e-commerce store you’re running, and typically there are two different models: acquiring or creating.

Imported goods

A huge percentage of Amazon and Shopify store owners are importing their goods from China. Under the importing model, your COGS combines the price you pay to your supplier (also known as First Cost) plus the total cost of import.

COGS = First Cost + Shipping

Shipping internationally typically includes sea freight + duty and local freight. You should also factor in costs such as local devan and repaletisation (essentially, unpacking and repacking of the container).

If you calculate the total, fully loaded cost of your order, you can apply this cost back to your SKUs to get the Landed Cost of your individual products.

For imported goods “Landed Cost” is synonymous with COGS: it’s the same thing.

Manufactured goods

For manufactured products, direct costs might include the cost of raw materials, packaging, direct labour, manufacturing and shipping to your warehouse or factory.

Again, calculate all of the production costs and apply the total cost back to your SKUs to determine your COGS. Why is COGS important?

COGS is important because it’s used to calculate Gross Margin which is essential for analysing potential products for sale at the business case stage, and post launch profitability performance.

Gross profit represents the difference between Net Revenue and the Cost of Goods Sold (COGS).

Net revenue, sometimes referred to as Net Sales, represents sales after accounting for taxes, cancellations, returns and discounts.

Gross profit = Revenue - COGS.

In our opinion, a healthy gross profit is in-between 60%-90% area. Anything less than 50% will in all likelihood result in net losses once you account for all other costs.

What is Cost of Sale?

As the term implies, CoS accounts for all of the costs associated with making a sale. Whilst COGS refers to the cost of getting your product ready for sale, CoS includes the direct costs associated with making a sale to your end consumers.

For a Shopify store, this typically includes things like Shopify transaction fees, 3PL fees and any costs which you can directly attribute to the sale of a product.

Why is important to differentiate between COGS and CoS?

In our businesses, we use CoS to calculate contribution margin, a profitability metric which lies in-between gross margin and operating margin. Contribution margin is a very helpful metric for omnichannel e-commerce businesses with lots of SKUs, multiple brands and several sales channels.

Imagine you have a brand which is available for sale on Amazon, Shopify, TikTok and Instagram. Whilst the COGS will always be the same for products sold across these channels, they each have different commission models and fulfillment fees so the CoS varies across channels. Attributing expenses to different channels can be tricky as some expenses may cut across channels and brands, but there are ways to do this effectively to build a good picture of profitability across all of your verticals.

Summary

In summary, distinguishing between Cost of Goods Sold (COGS) and Cost of Sale (CoS) in e-commerce businesses is essential and they each play a distinct role in profitability analysis. COGS represents the direct costs involved in acquiring or creating products, and is used to calculate Gross Margin. On the other hand, CoS includes all costs related to making a sale, such as transaction and fulfillment fees. Differentiating between COGS and CoS is important for accurately assessing Contribution Margin, especially in businesses with multiple sales channels and complex cost structures.